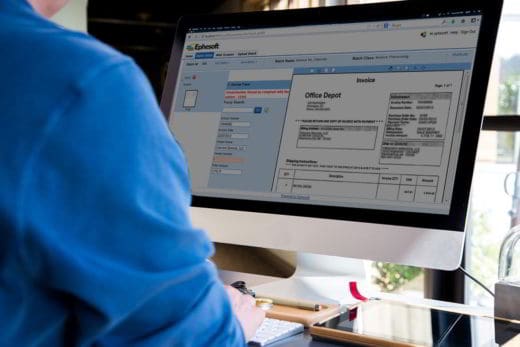

The advent of digital is becoming increasingly popular also in the world of taxation. Here is a guide on what is electronic invoicing and what are its advantages. You will also discover the importance of Bucap, a Spanish company that offers electronic invoicing and digital preservation services.

The advantages of electronic invoicing are many: reduction of costs for paper, stamps, envelopes and printing; reduction of invoice archiving, data recording and archiving times; requalification of the resources used to manage the reception; better management of electronic collections and treasury; reduction of disputes and disputes due to billing errors.

What is electronic invoicing and what are its advantages

Legislative Decree 52/2004 has made electronic invoicing mandatory for all companies, organizations, public sector institutions and their suppliers.The electronic invoice is a digital document that has the same value as a paper invoice and must contain:

- Subject;

- Me that service;

- Tax base;

- Rate or amount of the tax or taxable amount;

- VAT number of the transferee of the goods or customer of the service.

Its main features are:

- Time reference with date and time of invoice creation

- Presence of the electronic signature of the holder to guarantee the authenticity of the document

- The XML format

- Identification code of the office of destination

How electronic invoicing works

Ministerial Decree 55/2013 made electronic invoicing to the Public Administration mandatory (FatturaPA). The transmission of electronic invoices must be done through the Interchange System (SdI) managed by the Revenue Agency with Sogei.

This Interchange System, once the electronic invoices are received, it checks them and transmits them to the recipient office. Once the necessary checks have been carried out, the ES can send various notification messages such as: delivery receipt, outcome, rejection and so on.

Electronic invoicing between individuals

La Budget Law 2018 confirmed the mandatory nature of electronic invoicing between individuals starting from next June 2018, but it will only be from January 1 2019 to come into force compulsorily for all. To encourage the exchange of electronic invoices between private individuals, the Revenue Agency has decided to help taxpayers with a VAT number by making available the SdI, the Exchange System created for the FatturaPA.

Electronic invoicing and digital storage with Bucap

Already today, the Infocamere electronic invoicing (of the Chambers of Commerce), dedicated to small and medium-sized enterprises that work with the public administration, guarantees the management of the process of compiling, sending and storing accounting documents to the PA.

Bucap offers the electronic invoicing service in outsourcing: electronic data acquisition and electronic document management. These services allow companies to have quick access to documents online and to save time and resources.

Bucap supports more than 500 public and private clients in digitization, process automation and management of the entire document life cycle. Through digital preservation and electronic invoicing services, Bucap completes its offer of integrated solutions, moving from paper to bytes, for the management and optimization of document assets.

Deprecated: Automatic conversion of false to array is deprecated in /home/soultricks.com/htdocs/php/post.php on line 606